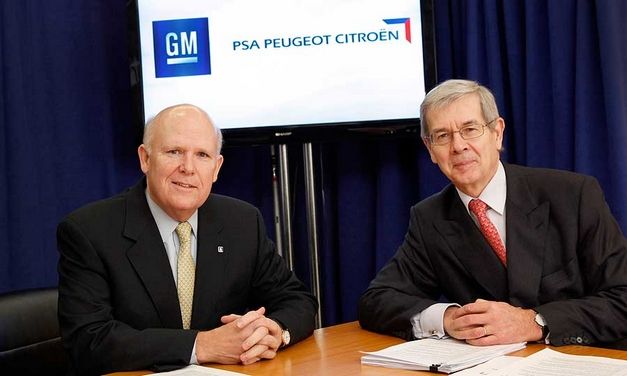

PSA Peugeot Citroen has agreed to form an alliance with General Motors targeting $2 billion in annual savings within five years.

“This partnership brings tremendous opportunity for our two companies,” GM’s CEO Dan Akerson said in a statement. “The alliance synergies, in addition to our independent plans, position GM for long-term sustainable profitability in Europe.”

GM will take a 7 percent stake in Peugeot as part of a share issue by the French automaker, and the two companies will pool research and development, vehicle platforms and technologies. GM is also expected to spend $400 million to $470 million for the 7-percent stake in Peugeot, Europe’s No. 2 automaker behind Volkswagen AG. The final investment will be determined by market conditions when terms of the rights offering are set.

In the statement, GM said the alliance is structured around two pillars: Firstly, the sharing of vehicle platforms, components and modules. Secondly, the creation of a global purchasing joint venture for the sourcing of commodities, components and other goods and services from suppliers with combined annual purchasing volumes of approximately $125 billion.

“Each company will continue to market and sell its vehicles independently and on a competitive basis,” the statement said.

The cost gains from the deal, which will coincide with the joint development of new vehicle platforms, will be limited in the first two years of the deal but will eventually total $2 billion a year, split about equally, the companies said.

The cost gains from the deal, which will coincide with the joint development of new vehicle platforms, will be limited in the first two years of the deal but will eventually total $2 billion a year, split about equally, the companies said.

GM and Peugeot said the alliance will initially focus on small and midsized vehicles, MPVs and crossovers. The automakers may also develop a new common platform for low emission vehicles, with the first model expected to launch by 2016.

GM officials told analysts today the deal is expected to close and take effect by the second half of 2012.

The deal, which comes as both Peugeot and GM’s Opel unit grapple with slow sales and overcapacity in Europe, has met with widespread skepticism among analysts and investors.

“This is not the type of solution we need to see in the European mass market, where capacity has to leave,” Credit Suisse analyst Erich Hauser told investors in a note.

“PSA needs GM, but GM doesn’t need PSA,” said Matthew Stover, an analyst with New York-based Guggenheim Securities. “It’s hard for me to figure out how this deal helps GM within Europe.”

Both automakers have excess capacity of about 25 percent in the region, Stover said, adding that the alliance risks “introducing complexity at a time when GM is at a very delicate point in its restructuring.”

The alliance with Peugeot is the first deal GM has reached with an automaker since its 2009 bankruptcy.

In 2005 and 2006, several years before its bankruptcy, GM sold off stakes in Japan’s Suzuki Motor Corp, Isuzu Motors and Fuji Heavy Industries Ltd. to raise cash. GM also explored mergers with U.S. rivals Chrysler and Ford Motor Co prior to its 2009 restructuring.

Other partnerships

GM has undertaken European partnerships in the past but with mixed results.

In 2005, GM doled out $2 billion to Fiat to end a failed alliance after 5 years. The next year, GM scuttled a partnership with Renault-Nissan that had been championed by then-shareholder Kirk Kerkorian.

PSA Peugeot has been more successful with targeted alliances across Europe, including joint ventures to build commercial vans with Fiat and engines with BMW AG.

PSA Peugeot has been more successful with targeted alliances across Europe, including joint ventures to build commercial vans with Fiat and engines with BMW AG.

A top Peugeot official said it would consult with engine partners BMW and Ford about any new alliances with GM or any other automakers.

“If there’s any agreement that goes beyond our existing partnerships, each of those partnerships will have to evaluate what can be done,” PSA industrial director Guillaume Faury told reporters at a briefing on Tuesday.

Peugeot makes diesel powertrains with Ford. The U.S. automaker today had no immediate concerns about the potential linkup between Peugeot and GM.

“Ford and PSA have a successful, long-term diesel engine cooperation,” a statement from Ford said. “PSA has a history of working with other automakers, and that has never compromised their relationship with us.

“We have built about 16.5 million diesel engines together over the past decade. With the potential to build up to three million engines a year, Ford and PSA are at the forefront of high efficiency, low CO2 diesel engine technology.”

BMW declined to comment on the partnership.

European struggles

Like Peugeot, Opel is struggling to reverse mounting European losses compounded by the region’s auto sales slump and cut-throat price competition. GM’s European operations lost $747 million last year, while Peugeot’s core auto division was $664 million in the red in the second half.

The Peugeot family, which owns just over 30 percent of the car maker, has signaled that it would not be opposed to some dilution providing it remained the principal shareholder.

(Source: Automotive News)